Introduction

Navigating the world of investments can be daunting, especially for beginners. With so many options and strategies available, it’s crucial to have reliable guidance. This is where Investiit.com tips come into play. This comprehensive guide aims to empower you with essential insights and strategies for making informed investment decisions. Whether you’re a novice investor or looking to refine your skills, these tips will serve as a valuable resource.

Understanding Investiit.com

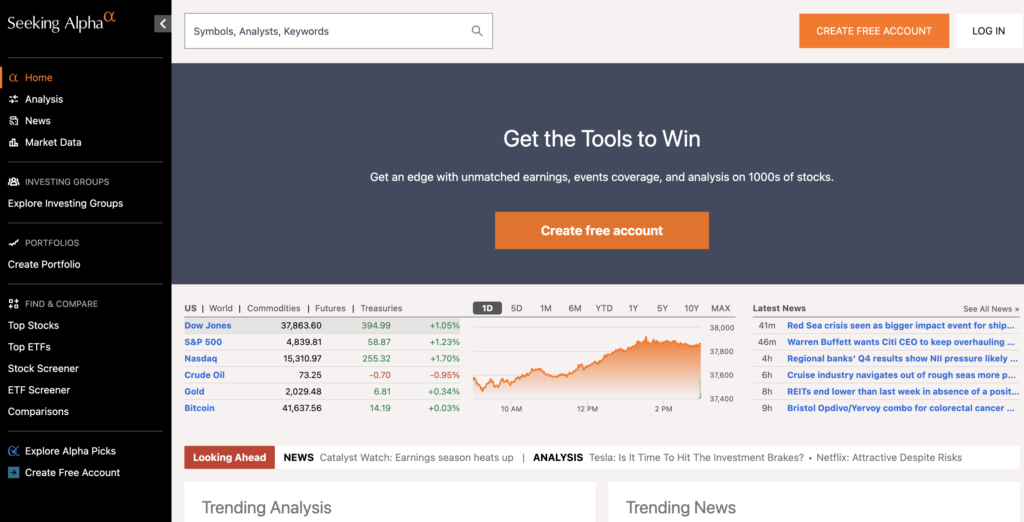

Before diving into specific tips, it’s important to understand what Investiit.com offers. This platform is designed to provide users with tools, resources, and educational materials focused on smart investing. From market analysis to personal finance strategies, Investiit.com is a one-stop shop for anyone looking to enhance their investment knowledge.

Key Features of Investiit.com

1. Educational Resources:

Investiit.com offers articles, videos, and webinars covering a wide range of topics, from basic investment principles to advanced strategies.

2. Market Analysis Tools:

Users can access real-time data and analytical tools that help in making informed decisions.

3. Community Engagement:

The platform fosters a community where investors can share insights, ask questions, and learn from one another.

4. Personalized Advice:

Investiit.com provides tailored recommendations based on individual financial goals and risk tolerance.

Investiit.com Tips for Successful Investing

1. Start with a Solid Foundation

Before making any investments, it’s crucial to have a clear understanding of the fundamentals. Investiit.com tips emphasize the importance of educating yourself about different asset classes, investment vehicles, and market dynamics. Take the time to learn about stocks, bonds, real estate, and mutual funds. This foundational knowledge will serve as a backbone for your investment journey.

Learning Resources

- – Books: Consider reading foundational books like “The Intelligent Investor” by Benjamin Graham or “A Random Walk Down Wall Street” by Burton Malkiel.

- – Online Courses: Websites like Coursera and Udemy offer courses in personal finance and investing basics.

- – Podcasts: There are numerous podcasts that focus on investment strategies and market trends, providing insights from seasoned investors.

2. Define Your Investment Goals

Every successful investment strategy begins with clear goals. Determine what you want to achieve—whether it’s saving for retirement, funding a child’s education, or building wealth. Investiit.com tips recommend setting both short-term and long-term goals. Short-term goals might include saving for a vacation, while long-term goals could involve purchasing a home or retiring comfortably.

SMART Goals Framework

| Specific: | Clearly define your goal. For example, “I want to save $50,000 for a home down payment.” |

| Measurable: | Make sure you can track your progress. |

| Achievable: | Set realistic goals based on your income and savings rate. |

| Relevant: | Ensure your goals align with your overall financial objectives. |

| Time-bound: | Set a deadline to achieve your goals. |

3. Assess Your Risk Tolerance

Understanding your risk tolerance is essential for creating an effective investment strategy. Investiit.com tips suggest evaluating your financial situation, investment experience, and emotional response to market fluctuations. This assessment will help you choose investments that align with your comfort level and financial objectives.

Risk Assessment Tools

- – Questionnaires: Many financial websites offer risk assessment questionnaires that can help you understand your risk appetite.

- – Consulting with Experts: Speaking with a financial advisor can provide personalized insights into your risk tolerance.

4. Diversify Your Portfolio

One of the most effective strategies for managing risk is diversification. Investiit.com tips highlight the importance of spreading your investments across various asset classes and sectors. By diversifying your portfolio, you reduce the impact of poor performance in any single investment, thereby enhancing overall stability.

Types of Diversification

- – Asset Class Diversification: Invest in a mix of stocks, bonds, real estate, and cash equivalents.

- – Sector Diversification: Within stocks, invest in different sectors such as technology, healthcare, and consumer goods.

- – Geographical Diversification: Consider international investments to mitigate local economic risks.

5. Stay Informed About Market Trends

Continuous learning is vital in the investment world. Investiit.com tips encourage investors to stay updated on market trends, economic indicators, and global events that could impact their investments. Regularly reading financial news, following reputable analysts, and participating in webinars can help you stay ahead of the curve.

Recommended Sources

- – Financial News Outlets: Follow publications like Bloomberg, CNBC, and The Wall Street Journal for up-to-date market information.

- – Investment Newsletters: Subscribing to newsletters from investment firms can provide curated insights and analysis.

6. Utilize Analytical Tools

Investiit.com offers a range of analytical tools that can aid in your investment decision-making process. From stock screeners to risk assessment calculators, these tools help you evaluate potential investments. Investiit.com tips suggest leveraging these resources to make data-driven decisions.

Key Analytical Tools

- – Stock Screeners: Use these to filter stocks based on specific criteria like market capitalization, P/E ratio, or dividend yield.

- – Financial Calculators: Utilize tools for calculating compound interest, retirement savings, and investment growth.

7. Create a Realistic Investment Plan

A well-structured investment plan is key to achieving your financial goals. Investiit.com tips recommend outlining your investment strategy, including asset allocation, investment horizon, and expected returns. A realistic plan will guide your investment decisions and help you stay focused.

Components of an Investment Plan

- – Asset Allocation: Decide the percentage of your portfolio to allocate to different asset classes.

- – Investment Horizon: Determine how long you plan to invest before needing the funds.

- – Expected Returns: Set realistic expectations for your investment growth based on historical performance.

8. Monitor Your Investments Regularly

Investing is not a set-it-and-forget-it endeavor. Investiit.com tips stress the importance of regularly monitoring your investments. Assess their performance, re-evaluate your goals, and make adjustments as needed. This proactive approach ensures that your investment strategy remains aligned with your financial objectives.

Monitoring Strategies

- – Regular Reviews: Schedule quarterly or semi-annual reviews of your portfolio to assess performance.

- – Set Alerts: Use platforms that allow you to set alerts for price changes or news related to your investments.

9. Be Patient and Stay Disciplined

Investing is often a long-term endeavor that requires patience and discipline. Investiit.com tips advise against making impulsive decisions based on short-term market fluctuations. Stick to your investment plan, and remember that successful investing often involves weathering the ups and downs of the market.

Techniques for Staying Disciplined

- – Automate Investments: Set up automatic contributions to your investment accounts to enforce discipline.

- – Avoid Emotional Trading: Develop a strategy for when to buy or sell, and stick to it regardless of market emotions.

10. Seek Professional Guidance

If you feel overwhelmed or uncertain, don’t hesitate to seek professional help. Investiit.com tips recommend consulting with financial advisors or investment professionals who can provide personalized advice tailored to your unique situation. Their expertise can help you navigate complex investment decisions with confidence.

Finding the Right Advisor

- – Qualifications: Look for advisors with relevant credentials such as CFP (Certified Financial Planner) or CFA (Chartered Financial Analyst).

- – Fee Structure: Understand how the advisor is compensated—fee-only, commission-based, or a combination.

The Importance of Continuous Learning

The investment landscape is ever-evolving, making continuous learning vital for success. Investiit.com tips encourage investors to regularly engage with educational materials, attend seminars, and participate in community discussions. By staying informed and adapting to new information, you can enhance your investment acumen and make better decisions.

Ways to Continue Learning

- – Webinars and Workshops: Participate in online events that focus on current market trends and investment strategies.

- – Networking: Join investment clubs or online forums to share experiences and learn from others.

Conclusion

Investing can be a rewarding journey when approached with the right knowledge and strategies. By following these Investiit.com tips, you can build a solid foundation for your investment endeavors and work toward achieving your financial goals. Remember, the key to successful investing lies in education, planning, and discipline. As you continue your investment journey, keep these tips in mind to navigate the complexities of the financial world with confidence.

In summary, Investiit.com tips provide valuable insights that can help you unlock the secrets to smart investing. Whether you’re just starting or looking to enhance your existing knowledge, these tips will guide you toward making informed decisions. Embrace the learning process, stay disciplined, and keep your eyes on the prize—financial success awaits!

FAQs

1. What is Investiit.com?

Investiit.com is a comprehensive platform that offers tools, resources, and educational materials focused on smart investing, helping users make informed financial decisions.

2. How can I assess my risk tolerance?

To assess your risk tolerance, evaluate your financial situation, investment experience, and how you emotionally respond to market fluctuations. This understanding will help you choose appropriate investments.

3. Why is diversification important in investing?

Diversification helps spread risk by investing across various asset classes and sectors, reducing the impact of poor performance in any single investment.

4. What tools does Investiit.com offer for investors?

Investiit.com provides a range of analytical tools, including stock screeners, risk assessment calculators, and market analysis tools to aid in decision-making.

5. How often should I monitor my investments?

Regular monitoring is essential; it’s recommended to review your investments at least quarterly to assess performance and make necessary adjustments to your strategy.